The Tax Filing Information form allows you to add, update, and view tax filing information for clients. A maximum of one tax filing record is allowed per tax year.

Prerequisites

- Ensure a client profile has been created for the client/family you are entering a tax filing record for.

Adding a Tax Filing

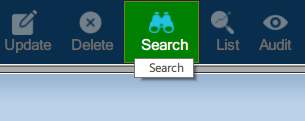

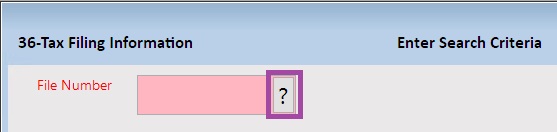

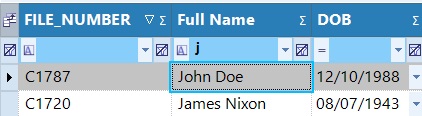

Step 1: Perform a search for the client you would like to add a tax filing for. For more details, please see our article on How to Search for a Client.

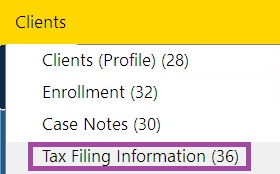

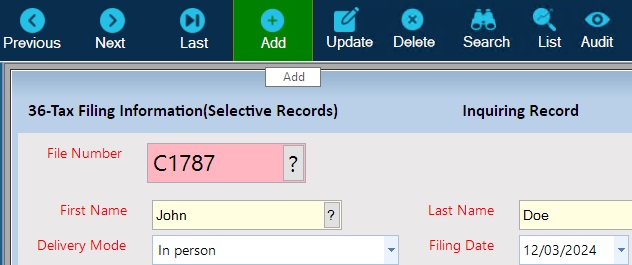

Step 2: Once you have found the client, navigate to Clients > Tax Filing Information (36).

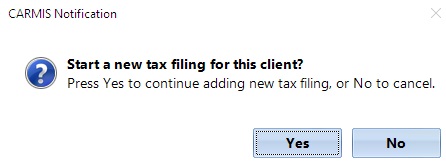

Step 3a: The system will check if any tax filings already exist in CARMIS for the selected client.

If there are no filings, then a message will appear asking if you would like to add one. Click Yes to proceed.

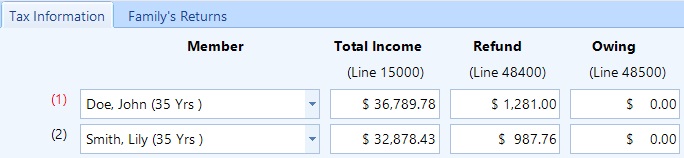

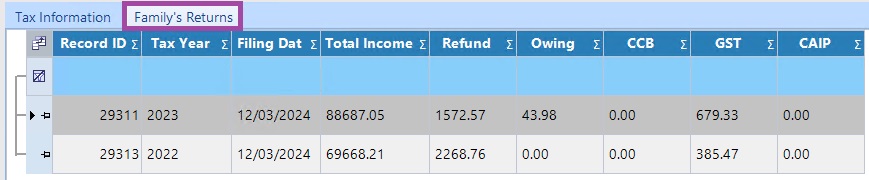

Step 3b: If some filings already exist, they will appear. In this case, click Add from the toolbar to add a new one. Please note: Family members will be automatically added.

Step 4: You can now begin entering information about the tax filing. Please note, When adding a tax filing, CARMIS will automatically include members in the Member fields, with the first member being mandatory. You can change the ordering of the members by clicking on the Member field drop down button and choosing a different member.

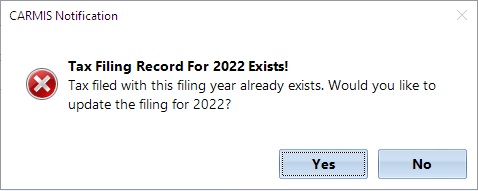

Please note: A maximum of one return may be recorded against each family per year. If a tax return already exists for the year, then you will receive a prompt asking if you would like to update the existing filing.

Step 5: Once you are satisfied with your changes, click Save. Please note that any changes not saved will be lost.

Viewing Reports / Summaries

At the bottom left of the report, you will notice three buttons for generating reports.

These include:

- Run Report - A report specific to this form, with one individual tax filing represented per row.

- View Summaries - A report for individual and family summary information. Each row represents a grouping based on a category.

- SEED Report - this will bring you to the SEED Report, if applicable for your agency